In this post, I'll be discussing the impact of demographics on economies, development, growth rates, and economic models more generally. This post will discuss a model that uses demographics and productivity growth to determine a country's growth potential over a longer-time horizon. In order to do so, I'll split this up into the different kinda demographic profiles. Then, I'll go into development levels which'll lead me to the differing structure of growth models and their adaptability to different kinds of economies. After all that, I'll summarize the point of the model.

Demographic Profiles:

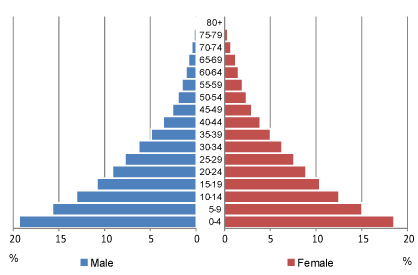

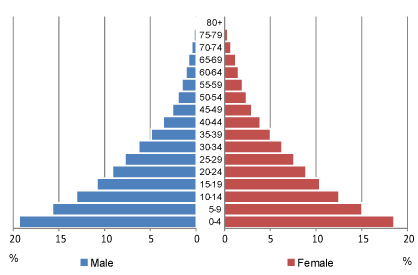

We can split up demographic profiles into three broad groups: pyramidal, stable, and inverted (as shown in chart below). A normal demography for a developing country is pyramidal wherein there's lots of young people and not many old people. Due to the cost of providing basic infrastructure and social services, countries with this demography are often in the 3rd world and poor.

A stable demography is most commonly seen in a developed economy or a developing economy with rising productivity. It's a population structure that can replace itself over the long-term, but the society won't see much population growth without immigration. The only OECD country in this position today is the US and France.

An inverted demography is the most common demography in the OECD today. Almost every OECD country has an inverted demography (as does China along with a few other poorer countries in Eastern Europe). The only thing that differs across the OECD, China, and the other poorer countries is the degree of the inversion. In places like Scandinavia, the demography is inverted, but not that inverted as TFR has been ~1.8 or so. So while there's an inversion, it's not that bad in places like Scandinavia.

/about/japan2-58b9cd163df78c353c381c76.jpg)

Development:

When you're a developing country, having a pyramidal population structure makes it very expensive for the society to provide everyone with basic social services and investments in items like healthcare and education. In such a demography, it may actually be economically healthy to reduce fertility rates cuz that ensures every child basic social services and investments in health and education that can really cause productivity to soar. In this type of demography, it's very feasible to see improved growth with reductions in populations from soaring productivity of investments in health and education.

So in the 3rd world, shifting from a pyramidal population structure to a stable or inverted structure may not be bad at all. On the contrary, such a shift may actually be necessary, healthy, and positive--especially over long time horizons. In the developed world, it's a very different story.

Most developed countries will see much slower productivity increase than the developing world simply cuz they're ahead and aren't playing catch-up, so they can't import technologies and things of the sort to rapidly cause a surge in productivity. Developed countries also often have much larger welfare states (especially in Europe, though less so in Asia). What that means is that the large welfare state with an inverted demography imposes a high cost burden on those paying into those welfare systems.

In order for first world countries with inverted demographics to cope with the pressure on their working populations, they must either let in more immigrants or cut benefits or suffer from the drag of higher debt/taxes. What this does is reduce resources for entrepreneurs and risk-takers while the inverted population makes consumption led growth more difficult. Due to the inability for future consumption levels to sustain themselves, this demography leads to a drop in productive investment opportunities.

In other words, the direct conclusion of an inverted demography without mass immigration is structurally lower growth unless you see large productivity increases, which're being seen in places like Japan and South Korea largely due to a mix of their reliance on commodity/raw materials/energy imports in a time of collapsing commodity/energy prices and improvements in automation, industrial robotics, etc..

Growth Models:

Obviously, demography has a large impact on a country's economic growth. A country with a growing population can sustain higher levels of consumption, and thus absorb higher levels of productive investment whose purpose is future consumption. This is true for both a developing and developed economy with a growing population.

In a developing economy, the potential for rising productivity is much higher cuz they're playing catch-up. In such a case, it's not necessary for a falling population to lead to lower growth in consumption over a medium to long-term horizon. In the short run, very high growth rates are possible under cases when a developing economy has a growing population or a falling population. In the long-term, there will be problems in terms of the dependency ratio though.

In higher income countries, low population fertility rates and low (or the wrong kind of) immigration are a certain drag on growth unless productivity growth grows very sharply. What's the likelihood of high productivity growth in large welfare states and rigid bureaucracies? It's not very high, so growth becomes very difficult in countries with these kinds of demographics and economic models that rely on large welfare states. In these kinds of countries, future economic growth will be tough to come by without serious structural reform.

In countries with stable demographic structures, both developing and developed countries will see long-term per capita growth that stays roughly in line with productivity. For a developed economy, a stable population and well-controlled immigration will generally yield ~3% economic growth, maybe a bit higher depending on productivity increases.

Developed countries with growing populations have the institutions to absorb more amounts of investment productively than developing countries, so it's actually the developed world with stable demographics and positive immigration that's best fit for a controlled infrastructure build-out. In addition to that, a consumption drive growth model can work as well.

Conclusion:

The fundamental point of this post is that long-term growth rates are always determined by structural factors. These structural factors are mathematically driven by productivity growth, population growth, and how people work (which's also structural, dependent on labor policy, etc). Hence, the applicability of growth models and economic models is entirely dependent on these structural factors.

What does this model of demographics tell us about future growth rates in the world today? It tells us that most of the developing world will continue to see surging productivity. That means many of them (like China) will be able to offset falling populations and falling workforce size by a surge in productivity. However, it also implies that most of the OECD will be stuck with low to no growth for decades unless productivity surges.

The primary exception in the OECD will be the United States. Another exception in the OECD may be France simply due to demographics. The rest of the OECD will see little to no growth unless they open themselves up to immigration, can filter these new immigrants effectively, have effective structural reform, and all while seeing surging productivity growth.

Demographic Profiles:

We can split up demographic profiles into three broad groups: pyramidal, stable, and inverted (as shown in chart below). A normal demography for a developing country is pyramidal wherein there's lots of young people and not many old people. Due to the cost of providing basic infrastructure and social services, countries with this demography are often in the 3rd world and poor.

A stable demography is most commonly seen in a developed economy or a developing economy with rising productivity. It's a population structure that can replace itself over the long-term, but the society won't see much population growth without immigration. The only OECD country in this position today is the US and France.

An inverted demography is the most common demography in the OECD today. Almost every OECD country has an inverted demography (as does China along with a few other poorer countries in Eastern Europe). The only thing that differs across the OECD, China, and the other poorer countries is the degree of the inversion. In places like Scandinavia, the demography is inverted, but not that inverted as TFR has been ~1.8 or so. So while there's an inversion, it's not that bad in places like Scandinavia.

/about/japan2-58b9cd163df78c353c381c76.jpg)

Development:

When you're a developing country, having a pyramidal population structure makes it very expensive for the society to provide everyone with basic social services and investments in items like healthcare and education. In such a demography, it may actually be economically healthy to reduce fertility rates cuz that ensures every child basic social services and investments in health and education that can really cause productivity to soar. In this type of demography, it's very feasible to see improved growth with reductions in populations from soaring productivity of investments in health and education.

So in the 3rd world, shifting from a pyramidal population structure to a stable or inverted structure may not be bad at all. On the contrary, such a shift may actually be necessary, healthy, and positive--especially over long time horizons. In the developed world, it's a very different story.

Most developed countries will see much slower productivity increase than the developing world simply cuz they're ahead and aren't playing catch-up, so they can't import technologies and things of the sort to rapidly cause a surge in productivity. Developed countries also often have much larger welfare states (especially in Europe, though less so in Asia). What that means is that the large welfare state with an inverted demography imposes a high cost burden on those paying into those welfare systems.

In order for first world countries with inverted demographics to cope with the pressure on their working populations, they must either let in more immigrants or cut benefits or suffer from the drag of higher debt/taxes. What this does is reduce resources for entrepreneurs and risk-takers while the inverted population makes consumption led growth more difficult. Due to the inability for future consumption levels to sustain themselves, this demography leads to a drop in productive investment opportunities.

In other words, the direct conclusion of an inverted demography without mass immigration is structurally lower growth unless you see large productivity increases, which're being seen in places like Japan and South Korea largely due to a mix of their reliance on commodity/raw materials/energy imports in a time of collapsing commodity/energy prices and improvements in automation, industrial robotics, etc..

Growth Models:

Obviously, demography has a large impact on a country's economic growth. A country with a growing population can sustain higher levels of consumption, and thus absorb higher levels of productive investment whose purpose is future consumption. This is true for both a developing and developed economy with a growing population.

In a developing economy, the potential for rising productivity is much higher cuz they're playing catch-up. In such a case, it's not necessary for a falling population to lead to lower growth in consumption over a medium to long-term horizon. In the short run, very high growth rates are possible under cases when a developing economy has a growing population or a falling population. In the long-term, there will be problems in terms of the dependency ratio though.

In higher income countries, low population fertility rates and low (or the wrong kind of) immigration are a certain drag on growth unless productivity growth grows very sharply. What's the likelihood of high productivity growth in large welfare states and rigid bureaucracies? It's not very high, so growth becomes very difficult in countries with these kinds of demographics and economic models that rely on large welfare states. In these kinds of countries, future economic growth will be tough to come by without serious structural reform.

In countries with stable demographic structures, both developing and developed countries will see long-term per capita growth that stays roughly in line with productivity. For a developed economy, a stable population and well-controlled immigration will generally yield ~3% economic growth, maybe a bit higher depending on productivity increases.

Developed countries with growing populations have the institutions to absorb more amounts of investment productively than developing countries, so it's actually the developed world with stable demographics and positive immigration that's best fit for a controlled infrastructure build-out. In addition to that, a consumption drive growth model can work as well.

Conclusion:

The fundamental point of this post is that long-term growth rates are always determined by structural factors. These structural factors are mathematically driven by productivity growth, population growth, and how people work (which's also structural, dependent on labor policy, etc). Hence, the applicability of growth models and economic models is entirely dependent on these structural factors.

What does this model of demographics tell us about future growth rates in the world today? It tells us that most of the developing world will continue to see surging productivity. That means many of them (like China) will be able to offset falling populations and falling workforce size by a surge in productivity. However, it also implies that most of the OECD will be stuck with low to no growth for decades unless productivity surges.

The primary exception in the OECD will be the United States. Another exception in the OECD may be France simply due to demographics. The rest of the OECD will see little to no growth unless they open themselves up to immigration, can filter these new immigrants effectively, have effective structural reform, and all while seeing surging productivity growth.

This was really an interesting topic and I kinda agree with what you have mentioned here!

ReplyDeletePersonal development