Trade Routes:

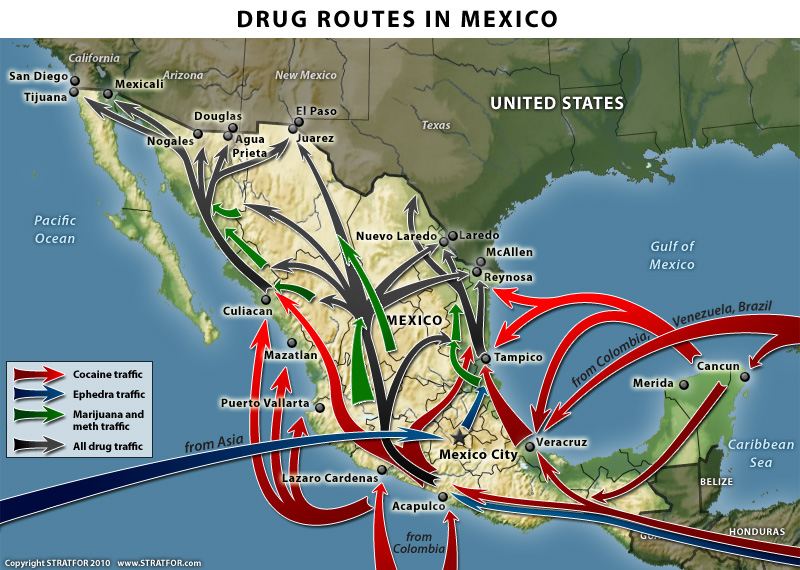

In the 1980's, the trade routes for the drug war was primarily in the Gulf of Mexico and the Caribbean Sea in the Atlantic. After the Cold War, the Americans realized they had the world's most powerful Navy and decided to shoot down planes going 10 feet above the Caribbean Sea at night with no lights on. Due to the sea lanes being cut off, the cartels were forced to operate through many different trade routes that connected the primary producers in northern South America (ex. Peru, Bolivia) to American demand in the US--note that the change in the trade routes are a large part of the increase in drug prices that occurred in the 90's. These trade routes went through different parts of Central America and Mexico. Many of the current conflicts in Mexico and Central America involving both the cartels and the Mexican government are related to American demand for drugs and the American drug policy. A map of the trade routes is shown below. Here is a link to an interactive map from The Economist on the trade routes for the drug war and the territory held by the different drug cartels.

Socio-Economic Impacts:

The economic impacts of the drug war for the US are relatively straight-forward. Inside the US, the drug war has made criminals out of people who aren't doing anything wrong. The current policy of the drug war include imprisoning people who are involved in dealing or using drugs. In the current policy, there is no incentive for those who happen to be addicted to various drugs to get actual help for their addiction. Instead, the current policy forces those who do have drug issues to resort to crime instead of resorting to medical treatment. In other words, we've forced people who have genuine health issues to resort to crime.

One of the consequences of the current drug policy and the drug war is that drug use is dealt with as a criminal problem instead of a public health problem. Let me make this abundantly clear: people who have real issues in dealing with drug use shouldn't be treated as criminals; they should be dealt with as patients. A second consequence is that we have people in charge have no incentive to help people genuinely overcome these health problems. Whether we look at it from the perspective of the police or of federal agencies such as the Drug Enforcement Agency (DEA), they currently have incentives in place whereby they gain more from punishing non-violent offenders with criminal charges or violence than they do from providing help.

Another direct economic consequences is that these policies of the drug war pit the cartels against one another and the Mexican government against the cartels. Rather than using resources to develop Mexican capital, increase Mexican productivity, and allow Mexico to become a better place to live with better social, political, economic, and financial institutions, these same resources are being used to fund unnecessary violence in the name of stupid policies backed by even dumber ideologies. The North American Drug War makes Mexico a more dangerous place by creating an incentive structure that increases government corruption (both Mexican and American), undermines the rule of law in both Mexico and the US, creates hostility between various factions in the Mexican Republic, and is destructive in virtually every single form.

Note: defending the Mexican-American border with troops is IMPOSSIBLE! It's over 2,500 miles and we don't have the troops or the money to protect it. A wall will be expensive and largely useless. It's too large of a border to patrol with troops or police. The real problem is that there is a genuine demand for certain luxury goods and services within our own country that has obvious public health implications. Instead of treating these issues like a social, sanitary, and public health problem, we've made it into a criminal problem by completely distorting the incentive structures for everyone involved.

Cartels as Corporations:

One excellent way to think of the behavior of the cartels is by thinking of them as (effective) corporations. In other words, they first start off by expanding up their supply chain like they have with cocoa producers in South America, which they've already done. Now, they've started to expand down the supply chain, which primarily includes fighting over territory, trade routes, and local suppliers. This is exactly what they've done. Much of the local distribution networks a few decades ago ran through gangs like the Bloods and Crips. Now, the Bloods and Crips are being eliminated and wiped out as the Mexican gangs are expanding their share of the local distribution networks in the US.

In the case of immigration, we have created a situation where the cartels must find ways of not only transporting the drugs into the country, but they must also keep distribution networks in tact. What does this mean? It means we should be seeing wars between cartels for control of these distribution networks, which is exactly what we're seeing. In order to do this, the cartels first start off by fighting over control of areas within Mexico. As we can see in the map above, cartels are fighting for territory in Mexico, there's been many wars/battles/conflicts/clashes between cartels, there's internal issues with violence related to drugs, and disputes over territory between cartels and even the Mexican government. When people/groups/organizations cannot settle disputes via a proper court system under the supervision of the rule of law, these same disputes are settled with violence.

Edit: See the map below which shows where the murders have occurred from 2006-2010. As you can see, most of the murders have been near the US. Note that most of the violence has been located near the US border as well.

What are the consequences? One of the consequences is possible issues from illegal immigration. Not only do the cartels require people to distribute these drugs, but there's (obviously) no incentives for the people coming here for/from the drug trade to document themselves or follow the law in any way. We run a major risk of increased violence and bad immigration from our Southern border. It's much easier to police immigration if the people want to come here for legal work as we can design institutions for people to do so that can enhance our country in a positive, productive manner. People that come here from drug trade related activities actively undermine the American rule of law, do not add productivity or capital (in addition to actually destroying capital) to our country, and actively work to destroy everything virtuous and honorable that we want to work towards in a society.

Other National Security Threats:

In order to understand the possibility of national security threats in the US, we first need to take a look at American geography. As we can clearly see, the US is bordered by the Atlantic Ocean to the east and the Pacific Ocean to the west. To the north, we have Canada that has a relatively small where almost of the Canadian population lives within 100 miles of the US and the entire northern region is protected by the Canadian Shield. In the southern border, we have a poorer country with a much larger and poorer population than Canada in Mexico whereby the border is basically desert. It's very difficult to monitor this region and all of the activity in this region. From all directions the US is a bitch to invade, so there aren't many security threats to begin with.

In relation to other possible issues of national security, everything else pales in comparison. We discuss places like Ukraine or Jihadism as a real threat to the American way of life, but they're really not. In the case of Ukraine, I won't go into too much detail as I've already written about this, but it's more about the US trying to undermine a foreign government for various geopolitical goals and national interests. It's not a direct national security threat unless Putin is somehow able to unify the Russian core, Siberia, and all of Europe under one empire, which would effectively be impossible at this point.

One of the causes of the rise in Islamic Jihad against the US was the constant interference that the Americans have had in other parts of the world (which was done, in large part to secure energy inputs and prevent the kinds of oil spikes we saw at the end of the last globalization cycle in the 1970's). However, the US is now the world's largest energy producer and there's plenty of supply regions in North America to provide the US with almost all of its oil. On top of this, many of the commodity exporters are experiencing financial difficulties from the correcting global supply/demand imbalances, which has forced countries like Russia to expand oil production along with places like Libya and Iraq. Inventories are also continuing to pile up. As of right now, there's no need to support autocratic, oppressive regimes to protect supply lines for critical economic inputs. This means the future threats from Islamic Jihad will be less of a threat in the US.

Also note that the places where Islamic Jihadist organizations are being taken up are in heavy natural resource rich countries that have no capital base in virtually any form. Groups like ISIS, the rebel movements in Libya, and Boko Haram in Nigeria come about, in large degree, as ways to take advantage of and extract natural resources. These activities are highly sensitive to shifts in commodity prices and their economies are not well diversified, which makes these places extremely fragile. The reason these groups are so repressive is primarily because:

1. They have to be. It's the only way they can maintain power.

2. They must control every aspect of their natural resource distribution networks to simply stay alive

3. They're able to gather the support of the populace in the region by using bogus forms of religion combined with using the revenue from natural resources and plunder to provide social services.

Islamic Jihad organizations are, in my view, primarily because there's an opportunity to extract natural resources. However, it becomes important to note that capital is actually being destroyed and these groups have horrific records on environmental protection. These are costs that will be borne by future generations and make these groups inherently fragile. Simply put, Islamic Jihad is not a robust ideology or way of rule for any extended time frame. It's extremely fragile and groups like ISIS are likely to blow up and it was former American foreign policy that was responsible in letting it persist for so long.

Solutions to American National Security Threats:

Am I saying that Islamic Jihadism is not a threat to the US? Of course not. It's a very real threat, but if managed properly and handled with reason and sensibility, we can minimize the impact to the American heartland coming from these kinds of groups. The best way to deal with the risk of terrorism and other threats of Islamic Jihad is by not supporting places, countries, and groups that take up these ideologies (ex. the US alliances with Saudi Arabia over the past few decades). NATION-BUILDING DOES NOT WORK! Instead, nation-building increases the hostility of the populace of the region towards the US and puts the American population at greater risk.

The primary national security threat of the US comes from the only place that it really can: south of the border. The obvious way to reduce the risks of this threat is to help economically develop Mexico and to help Mexico accumulate capital. Through this framework, you can limit the kinds of threats that can arise from there by reducing the incentive for people to cross an entire gigantic desert to find a better place to live. The best policy for all sides involved is an economically beneficial alliance that allows American capital to fund productive/necessary ventures/projects (like critical infrastructure) in Mexico, allows Mexico to develop, and increase the standard of living for the average Mexican.

The best way to rule is by virtue and reputation of strength instead of fear, hatred, and apprehension. This is the way we must deal with Mexico. We should want Mexico to not only be in our alliance, but want them to be like and emulate us. The most dangerous national security policy is one that creates hatred and resentment towards the American Republic in a bordering country which would currently be the North American Drug War. It's time to end the North American Drug War!