This post is about the important topic of why capitalism works. The most common answers to why capitalism works usually has to do with concepts like economies of scale, the advantages of specialization and how specialization strengthens economies, and the idea of capitalist economies being more "efficient". These reasons for why capitalism works is complete nonsense. First off, economies of scale doesn't show in the data: as firms get larger, they become more fragile. Secondly, specialized economies are not a sign of strength but a sign of weakness as small shifts in international supply/demand in the aggregate or in a few goods can cause the economies to blow up. Thirdly, economic efficiency means nothing without talking about geopolitical risk.

Let's start off by talking about the idea of economies of scale. As firms get larger, they usually gain a greater and greater control of the market share. This may seem like a good thing, but it's really not. Why is firms gaining a larger and larger singular share of the market not a good thing? The reason becomes clear when we look at the upside vs the downside. As firms get larger, their upside becomes limited because the markets often become saturated while the downside remains the same (they can go to zero). In other words, as firms get larger, their possible upside reaches some kind of a limit while the downside remains the same at zero. So, by definition, the larger firms become, the more fragile the firms actually become. Eventually, when firms become large enough, small shifts in consumer preferences or supply side shifts or any small shock can doom the firms. This is why, in many cases, economies with a few large firms often buy out politicians and bureaucrats while using government agencies in the name of "regulation" to start controlling economies. These kinds of ideas are what usually gets called as "free market" ideas, but this kind of economic system usually ends in a rentier economy where a few people control the entire economy. This also leads to burgeoning economic inequality as the middle class gets completely wiped out while the families of a few oligarchs run the entire society. Over the past 40 years, we've seen this procedure play out in the US starting in the late 70's and early 80's with Jimmy Carter and Ronald Reagan. These ideas are about as crony capitalist as they get.

Not only is the idea of economies of scale hogwash, but specialization in an economy isn't a sign of strength. Why is specialization not a sign of strength? Usually, this specialization argument leads to emerging markets and less developed countries (LDCs) specializing in things like commodity production. The reason is because LDCs don't have the ability to compete directly with developed countries on the production of goods and services that require capital inputs. Not only do LDCs usually specialize in commodity production or low wage labor, but we must remember that commodities and raw materials are primarily used as inputs in other economies. It's also important to note that commodity prices and the demand for raw materials is highly sensitive to shifts in the worldwide demand for raw materials, the current production levels of other countries, the geopolitical climate, and a whole host of other factors. In other words, the specialization theory actually makes economies extremely fragile as any shock can blow up these economies. Specialized economies aren't even close to robust and are often banana republics.

Expecting LDCs to remain specialized is usually used as a theoretical justification for an elite to extract rent from these much poorer countries while leaving the mass populace of these countries repressed. Diverse economies, on the other hand, are much more robust. Small shocks not only don't affect diverse economies on the same scale, but they actually strengthen diverse economies. Due to their diverse nature, economies that are diverse will experience some volatility in the system, but other industries are able to brace and even strengthen by the negative impacts caused by the shock. In diverse economies, shocks lead to volatility that allows the system to adjust rapidly and quickly--although there may be a small short term cost, the small short term costs create long term structural benefits. The people who really get hosed in a diverse economy are the rent-seeking, unproductive elite. Basically, we can think of specialized economies as being short volatility and diverse economies as being long volatility.

We must remember that economic systems codevelop with geopolitical systems. What this means is that the tradeoff between economic efficiency and geopolitical risk is an important one. It may be more "efficient" in the short run for an economy to specialize in certain types of production, but small international shocks can have a major impact for specialized economies. In other words, specialized economies are actually highly leveraged and can be extremely fragile. History hasn't been kind to highly specialized economies and has led to famines and depressions in many countries when exports or worldwide demand suddenly collapses.

So this bring us to the next question: why does capitalism work?

Capitalism works primarily because it allows an economic system the ability to adjust automatically to shocks in a decentralized and robust manner. The shocks happen instantly to any sight of volatility as short term shocks allow the system as a whole to develop longer term structural advantages. In other words, decentralized capitalist economies are robust, and even antifragile, because they adjust automatically to shocks. Centralized or centrally planned economies are often the opposite. They often get locked into single policy options while the primary players (usually a non-productive elite) often have little skin in the game and are usually worried more about covering their own ass than they are about the actual health of the economy overall.

Another strength about capitalist economies is that they're the only economies that actually have the capacity to become diverse, and thus robust. Due to the decentralized nature of capitalism, all sorts of different ideas and industries can co-develop together. As shocks hit the economy, the economy adjusts very rapidly and quickly. If something does go wrong, individual agents in the economy can come together, cooperate, and voluntarily work together in ways that centrally planned economies simply cannot. We must remember that economies are systems with many different moving parts. Having fragility at the localized level is a requirement to having antifragility, and sometimes even being robust, at the systemic level

We must understand that uncertainty plays a critical role in economic systems (and in almost all organic, complex systems). Decentralized economies can adjust to, and benefit from more uncertainty and unpredictability. Centralized systems, on the other hand, do not have the same response to uncertainty. We must also remember that centralized systems are built from the top-down, which implies that one small policy error at the top can blow the entire system to smithereens. Decentralized capitalist economies do not have to worry about the same problems because the decision making isn't centralized.

Another important note about centralized systems is that there is no volatility at the surface due to their centralized, top-down structure. In other words, there's a build-up of risk underneath the system while the system exhibits no visible risks at the surface due to the suppression of volatility. This is the exact same phenomenon we see occur in forests when all of the small forest fires of a forest are put out quickly. Flammable deadwood builds up at the forest floor and the forest fires, although they occur less often, are much larger in size, scope, and damage. This is why we see controlled burns occur in most forests that're managed by human beings now. Economic systems exhibit the exact same phenomenon because, like environmental systems, they've got an organic, bottom-up structure.

My thoughts on math, markets, politics, geopolitics, and a whole bunch of other random stuff.

Monday, August 25, 2014

Wednesday, August 20, 2014

Europe's Conundrum

Anyways, Europe has many (major) problems and upcoming hurdles. This post will detail the hurdles I find to be the most important hurdles. I will separate this post into various parts with the parts being:

1. Introduction

2. The Euro and the Gold Standard

3. The Question of Austerity

4. The European Banking System

5. Asset Bubbles in Northern Europe

6. The Question of Germany

7. European Demographics

8. Conclusion

Introduction:

Europe is in the middle of an economic crisis (if that isn't blatantly obvious). There is simply too much debt across Europe. The fundamental problem in Europe is that they tried to set up a unified currency when there's absolutely no reason for a unified currency for Europe. The bureaucrats/politicians in charge of the European Union (I'll refer to them as Eurocrats from now on) wanted to create a geopolitical alliance to merge Europe socially and politically. They thought the best way to do this was to create a unified currency and a unified monetary authority. Of course, they also decided to completely ignore a fiscal alliance between the countries, which now leaves all of Europe with a major problem.

The Euro and the Gold Standard:

I like the Euro today to the gold standard of the 1930's. We've got countries (Portugal, Italy, Ireland, Greece, and Spain) having debts denominated in currencies they can't control. These countries find themselves with very high levels of unemployment and absolutely no demand while they've got massive debt burdens in both the private and public sectors. Also note that their debts are assets of some financial institution. In the case of Europe today, the debts of the PIIGS (Portugal, Italy, Ireland, Greece, and Spain) are primarily held by German and French banks. So we've got countries with massive and unsustainable debt burdens on one side while we've got countries who hold those debts on the other side.

The problem for the PIIGS is that if they were to leave the Euro and devalue, their debts would remain denominated in Euros. So if Spain were to leave the Euro and return to Pesetas, the drop in the value of the Peseta would mean that the real debt burden for Spain would go up. If the Peseta dropped 50% overnight vs the Euro, that'd imply a 100% increase in the real debt burden for Spain. In other words, there's really nothing Spain can do to relieve its debt burden. However, some people would argue about the merits of austerity and say that the austerity taken up in these countries can fix their problems. This is nonsense.

The Question of Austerity:

AUSTERITY IS NOT THE PROBLEM OR THE SOLUTION! These countries are stuck in a situation where there is absolutely no demand for goods and services in the country. The reason the fiscal deficits in these countries are so large is primarily because the falling demand is putting a massive downward pressure on tax revenues. Trying to fix Europe's problems by trying to cut deficits is useless because deficit cutting reduces the turnover of money (and thus aggregate demand) in the private sector. The austerity proponents would argue that countries like the UK and (to a lesser extent) the US have been able to deal with austerity and they've been just fine. Of course, they completely miss that the US and the UK are sovereign currency issuers. In other words, the US and UK can simply have their central banks expand their balance sheets in order to prevent a bank run or simply increase the base money supply and provide cash as necessary for the private sector so that there isn't a total collapse in the financial system. None of the countries in Europe can do this and if there is a problem with the financial sector in Europe, they get screwed. Austerity clearly doesn't help reduce the public debt burdens of any of the PIIGS (as shown below).

The European Banking System:

Another major problem in Europe is the banking system. There's been much talk about how bad the situation is with the US banking system and how things were in 2008. Europe's situation is about 1000 times worse. First of all, the European banking system is much larger as a portion of GDP. Secondly, the European banking system is also much more leveraged with much lower capital standards (ex. the bank capital/assets ratio in Germany is 5.5%). The lower capital standards imply that there's less of a cushion for the potential losses of the banking system while the large size of the banking system as a whole imply that the risk of a fall in their assets has more potential downside. In other words, the risk of a loss in bank capital is much greater for the European banking system while the costs of recapitalizing the European banking system would be much greater on the sovereign governments involved.

So what does the European banking system have to do with the creation of the Euro? Well, the creation of the Euro meant that the banking system of all of the European countries effectively came together (monetary union). During the boom period, the spreads between German sovereign debt and the debt of the PIIGS collapsed, as shown in the chart below. In other words, the risk of holding German debt vs the debts of countries like Ireland and Greece was considered to be effectively the same. Also note that in the early to mid 2000's, it was the countries of Portugal, Italy, Ireland, Spain, and Greece that were booming while the German economy was in the doldrums. So we basically had economies that were booming see interest rates collapse which caused liquidity to expand. Naturally, this led to large, unsustainable asset bubbles where capital flew out of the European interior (primarily Germany and France) and into the periphery. During this process, German and French banks ended up acquiring the debts of various sovereign governments in the periphery. In other words, many of the assets of the German and French banks are the sovereign debts or other liabilities of the European periphery.

Note: All of the lines shown above are 10 year bond yield spreads between the PIIGS and Germany where Portugal is dark blue, Italy is brown, Ireland is green, Greece is purple, and Spain is light blue/turquoise.

Remember how I earlier stated that the debt burdens of the PIIGS are getting larger and larger while the budget cuts are having little effect on the debts and deficits of these countries. I do not think there's a way out for any of these countries unless a good portion of these debts are written down and the losses are taken. The problem is that while a debt restructuring would help the PIIGS, the holders of the assets of the PIIGS (primarily German and French banks) would be hurt more than anyone else. Also note that credit has effectively been socialized (ex. deposit insurance), which means that the losses of the banks of Germany and France are effectively the losses of the sovereign governments. So a debt restructuring (or even the PIIGS leaving the Euro) for the PIIGS would force Germany and France into recapitalizing their banking systems--a loss that will eventually show up in the debts of those sovereigns in one form or another. The cost of a default/devaluation of the PIIGS would end up being borne by the rest of the countries who remain in the Euro.

Also note that if the PIIGS started to leave the Euro, we'd likely see a strengthening of the Euro as all of the weaker countries drop out. In other words, the Euro will strengthen while newly issued currencies like the Peseta and Drachma would fall. It's important to notice that a Euro strengthening in such a scenario would imply that the real debt burdens of the PIIGS would soar much higher than expected.

Asset Bubbles in Northern Europe:

There's also a problem of asset bubbles in Europe. Countries like France, the Netherlands, the UK, along with Finland and a few other countries currently have asset bubbles as price/rent ratios (chart shown below) have surged and house prices haven't come back down to sustainable levels. Once house prices and private debts (in nominal levels) start to fall, the debt increases that were adding to growth and incomes will start to detract from growth and incomes.

Note: The chart above starts from Q1 of 1996 and goes to Q3 of 2012. The chart is (obviously) taken from The Economist and the app can be found here. A more recent app that details similar statistics can also be found here.

In these countries, aggregate demand will start to fall and the fall in incomes will make it more difficult for people in these countries to be able to handle their large debt burdens. Unemployment will rise as tax revenues take a dive while government spending will increase (particularly towards automatic stabilizers). We're likely to see rising unemployment, rising public debts, and falling incomes and aggregate demand in much of Europe over the next 5-10 years. So while the periphery of the Eurozone is currently mired in a depression due to a lack of demand, much of the other half of Europe is stuck with excess capacity fueled by debt. When the excess capacity (asset bubbles) starts to fall, the demand in these regions will take a hit as well. In other words, we're likely to see falling demand in Europe as a whole and the Northern parts of Europe will end up with a major correction in asset markets. The falling capacity will worsen the demand problem in all of Europe since falling capacity and rising unemployment will imply less income, and thus demand, for all of Europe.

The Question of Germany:

When people talk about the positive aspects of Europe, they bring up Germany. Often, the argument goes that Germany is fiscally responsible and that Germany, by itself, can completely save all of Europe. This argument is complete bullshit. Germany has >80% government debt/GDP while the German banking system holds less capital than the US banking system, the assets of the German banking system are highly questionable with regards to their quality, and the German banking system is also much larger (with respect to income and production) than the banking system in the US. If we add in the cost of recapitalizing the German banking system into Germany's government debt, Germany's national debt could already be larger than the US by that single addition alone. Also note that Germany's track record of fiscal responsibility doesn't have very much behind it, particularly considering that Germany has defaulted on its own debt twice in the past 100 years.

Remember when I said that if the PIIGS left the Euro, the Euro would strengthen. Well, that's a very important point because Germany has been the largest benefactor of the Euro since its inception. The trade disadvantages of the PIIGS really ended up as trade advantages for Germany as Germany was working with an undervalued currency. When the PIIGS leave the Euro (they will end up leaving the Euro or suffer at least another 5-10 years of extremely high unemployment), they'll effectively force much of their unemployment towards Germany as Germany will end up losing its trade advantage from the Euro. So not only will Germany's banking system be on the hook for the losses on its debt ownership of the PIIGS, but Germany will also lose its trade advantages as the unemployment will eventually rise. The drop in capacity and rise in unemployment in Germany will decrease German demand and tax revenues while the German deficits and debt continue to increase. Germany is not, and will not, be the savior of Europe. The reality shows that Germany is one of the sickest countries in Europe, but the sickness is being hidden.

European Demographics:

In the developed world, we're starting to see population decline and Europe isn't the exception. Fertility rates in most of the European countries (particularly Western and Northern Europe) have plunged over the past 40 years. In almost all cases, the fertility rates are below 1.6 and, in some cases, have been <1.6 for over 40 years (a graph of European fertility rates is shown below). With the exception of the Scadinavian countries and a few others, most of Europe is in population decline. Obviously, less people means less future productive capacity and less people working. Also note that the worsening European population demography implies rising dependency rates as the elderly portion of the population surges relative while the population workforce size starts to fall. The falling dependency ratio implies less future growth and lower debt capacity for every single one of these countries. Also note that entitlement systems in many of these countries tend to be rather generous which just implies either higher future costs for a smaller workforce to bear or less benefits for future retirees from the governments.

1. Introduction

2. The Euro and the Gold Standard

3. The Question of Austerity

4. The European Banking System

5. Asset Bubbles in Northern Europe

6. The Question of Germany

7. European Demographics

8. Conclusion

Introduction:

Europe is in the middle of an economic crisis (if that isn't blatantly obvious). There is simply too much debt across Europe. The fundamental problem in Europe is that they tried to set up a unified currency when there's absolutely no reason for a unified currency for Europe. The bureaucrats/politicians in charge of the European Union (I'll refer to them as Eurocrats from now on) wanted to create a geopolitical alliance to merge Europe socially and politically. They thought the best way to do this was to create a unified currency and a unified monetary authority. Of course, they also decided to completely ignore a fiscal alliance between the countries, which now leaves all of Europe with a major problem.

The Euro and the Gold Standard:

I like the Euro today to the gold standard of the 1930's. We've got countries (Portugal, Italy, Ireland, Greece, and Spain) having debts denominated in currencies they can't control. These countries find themselves with very high levels of unemployment and absolutely no demand while they've got massive debt burdens in both the private and public sectors. Also note that their debts are assets of some financial institution. In the case of Europe today, the debts of the PIIGS (Portugal, Italy, Ireland, Greece, and Spain) are primarily held by German and French banks. So we've got countries with massive and unsustainable debt burdens on one side while we've got countries who hold those debts on the other side.

The problem for the PIIGS is that if they were to leave the Euro and devalue, their debts would remain denominated in Euros. So if Spain were to leave the Euro and return to Pesetas, the drop in the value of the Peseta would mean that the real debt burden for Spain would go up. If the Peseta dropped 50% overnight vs the Euro, that'd imply a 100% increase in the real debt burden for Spain. In other words, there's really nothing Spain can do to relieve its debt burden. However, some people would argue about the merits of austerity and say that the austerity taken up in these countries can fix their problems. This is nonsense.

The Question of Austerity:

AUSTERITY IS NOT THE PROBLEM OR THE SOLUTION! These countries are stuck in a situation where there is absolutely no demand for goods and services in the country. The reason the fiscal deficits in these countries are so large is primarily because the falling demand is putting a massive downward pressure on tax revenues. Trying to fix Europe's problems by trying to cut deficits is useless because deficit cutting reduces the turnover of money (and thus aggregate demand) in the private sector. The austerity proponents would argue that countries like the UK and (to a lesser extent) the US have been able to deal with austerity and they've been just fine. Of course, they completely miss that the US and the UK are sovereign currency issuers. In other words, the US and UK can simply have their central banks expand their balance sheets in order to prevent a bank run or simply increase the base money supply and provide cash as necessary for the private sector so that there isn't a total collapse in the financial system. None of the countries in Europe can do this and if there is a problem with the financial sector in Europe, they get screwed. Austerity clearly doesn't help reduce the public debt burdens of any of the PIIGS (as shown below).

The European Banking System:

Another major problem in Europe is the banking system. There's been much talk about how bad the situation is with the US banking system and how things were in 2008. Europe's situation is about 1000 times worse. First of all, the European banking system is much larger as a portion of GDP. Secondly, the European banking system is also much more leveraged with much lower capital standards (ex. the bank capital/assets ratio in Germany is 5.5%). The lower capital standards imply that there's less of a cushion for the potential losses of the banking system while the large size of the banking system as a whole imply that the risk of a fall in their assets has more potential downside. In other words, the risk of a loss in bank capital is much greater for the European banking system while the costs of recapitalizing the European banking system would be much greater on the sovereign governments involved.

So what does the European banking system have to do with the creation of the Euro? Well, the creation of the Euro meant that the banking system of all of the European countries effectively came together (monetary union). During the boom period, the spreads between German sovereign debt and the debt of the PIIGS collapsed, as shown in the chart below. In other words, the risk of holding German debt vs the debts of countries like Ireland and Greece was considered to be effectively the same. Also note that in the early to mid 2000's, it was the countries of Portugal, Italy, Ireland, Spain, and Greece that were booming while the German economy was in the doldrums. So we basically had economies that were booming see interest rates collapse which caused liquidity to expand. Naturally, this led to large, unsustainable asset bubbles where capital flew out of the European interior (primarily Germany and France) and into the periphery. During this process, German and French banks ended up acquiring the debts of various sovereign governments in the periphery. In other words, many of the assets of the German and French banks are the sovereign debts or other liabilities of the European periphery.

Note: All of the lines shown above are 10 year bond yield spreads between the PIIGS and Germany where Portugal is dark blue, Italy is brown, Ireland is green, Greece is purple, and Spain is light blue/turquoise.

Remember how I earlier stated that the debt burdens of the PIIGS are getting larger and larger while the budget cuts are having little effect on the debts and deficits of these countries. I do not think there's a way out for any of these countries unless a good portion of these debts are written down and the losses are taken. The problem is that while a debt restructuring would help the PIIGS, the holders of the assets of the PIIGS (primarily German and French banks) would be hurt more than anyone else. Also note that credit has effectively been socialized (ex. deposit insurance), which means that the losses of the banks of Germany and France are effectively the losses of the sovereign governments. So a debt restructuring (or even the PIIGS leaving the Euro) for the PIIGS would force Germany and France into recapitalizing their banking systems--a loss that will eventually show up in the debts of those sovereigns in one form or another. The cost of a default/devaluation of the PIIGS would end up being borne by the rest of the countries who remain in the Euro.

Also note that if the PIIGS started to leave the Euro, we'd likely see a strengthening of the Euro as all of the weaker countries drop out. In other words, the Euro will strengthen while newly issued currencies like the Peseta and Drachma would fall. It's important to notice that a Euro strengthening in such a scenario would imply that the real debt burdens of the PIIGS would soar much higher than expected.

Asset Bubbles in Northern Europe:

There's also a problem of asset bubbles in Europe. Countries like France, the Netherlands, the UK, along with Finland and a few other countries currently have asset bubbles as price/rent ratios (chart shown below) have surged and house prices haven't come back down to sustainable levels. Once house prices and private debts (in nominal levels) start to fall, the debt increases that were adding to growth and incomes will start to detract from growth and incomes.

Note: The chart above starts from Q1 of 1996 and goes to Q3 of 2012. The chart is (obviously) taken from The Economist and the app can be found here. A more recent app that details similar statistics can also be found here.

In these countries, aggregate demand will start to fall and the fall in incomes will make it more difficult for people in these countries to be able to handle their large debt burdens. Unemployment will rise as tax revenues take a dive while government spending will increase (particularly towards automatic stabilizers). We're likely to see rising unemployment, rising public debts, and falling incomes and aggregate demand in much of Europe over the next 5-10 years. So while the periphery of the Eurozone is currently mired in a depression due to a lack of demand, much of the other half of Europe is stuck with excess capacity fueled by debt. When the excess capacity (asset bubbles) starts to fall, the demand in these regions will take a hit as well. In other words, we're likely to see falling demand in Europe as a whole and the Northern parts of Europe will end up with a major correction in asset markets. The falling capacity will worsen the demand problem in all of Europe since falling capacity and rising unemployment will imply less income, and thus demand, for all of Europe.

The Question of Germany:

When people talk about the positive aspects of Europe, they bring up Germany. Often, the argument goes that Germany is fiscally responsible and that Germany, by itself, can completely save all of Europe. This argument is complete bullshit. Germany has >80% government debt/GDP while the German banking system holds less capital than the US banking system, the assets of the German banking system are highly questionable with regards to their quality, and the German banking system is also much larger (with respect to income and production) than the banking system in the US. If we add in the cost of recapitalizing the German banking system into Germany's government debt, Germany's national debt could already be larger than the US by that single addition alone. Also note that Germany's track record of fiscal responsibility doesn't have very much behind it, particularly considering that Germany has defaulted on its own debt twice in the past 100 years.

Remember when I said that if the PIIGS left the Euro, the Euro would strengthen. Well, that's a very important point because Germany has been the largest benefactor of the Euro since its inception. The trade disadvantages of the PIIGS really ended up as trade advantages for Germany as Germany was working with an undervalued currency. When the PIIGS leave the Euro (they will end up leaving the Euro or suffer at least another 5-10 years of extremely high unemployment), they'll effectively force much of their unemployment towards Germany as Germany will end up losing its trade advantage from the Euro. So not only will Germany's banking system be on the hook for the losses on its debt ownership of the PIIGS, but Germany will also lose its trade advantages as the unemployment will eventually rise. The drop in capacity and rise in unemployment in Germany will decrease German demand and tax revenues while the German deficits and debt continue to increase. Germany is not, and will not, be the savior of Europe. The reality shows that Germany is one of the sickest countries in Europe, but the sickness is being hidden.

European Demographics:

In the developed world, we're starting to see population decline and Europe isn't the exception. Fertility rates in most of the European countries (particularly Western and Northern Europe) have plunged over the past 40 years. In almost all cases, the fertility rates are below 1.6 and, in some cases, have been <1.6 for over 40 years (a graph of European fertility rates is shown below). With the exception of the Scadinavian countries and a few others, most of Europe is in population decline. Obviously, less people means less future productive capacity and less people working. Also note that the worsening European population demography implies rising dependency rates as the elderly portion of the population surges relative while the population workforce size starts to fall. The falling dependency ratio implies less future growth and lower debt capacity for every single one of these countries. Also note that entitlement systems in many of these countries tend to be rather generous which just implies either higher future costs for a smaller workforce to bear or less benefits for future retirees from the governments.

Note: The chart shown above is the total fertility rate for selected European countries over the past 40 years. This data comes from the world bank and can be found here.

Conclusion:

When I look at the economic factors and combine all of the upcoming hurdles of Europe, I find it difficult to find any solution other than massive debt writedowns. Even writing down all the debts will not fix Europe's problems and there is no real way against future pain. Since around the 17th century to until 50-60 years ago, the European powers were the ones to really rule the world. Now, those same European powers find themselves in secular decline and there's no real easy way out. The pain has to be taken and there's a good chance that European living standards could even drop over the next few decades. The current levels of (both public and private) debt in Europe also make war a realistic possibility, which would further weaken the geopolitical power of these countries.

The real problem in Europe has been the ideology that runs these countries. In many of these countries, the left side effectively consists of hardline self-described socialists on the left while the other side consists of fascists or similar ideologies. We see this political fault line starting to develop or already have developed in many European countries (ex. Front National in France, Golden Dawn in Greece). Over the next few decades, we're likely to see Europe lose power and influence on the world stage while there's a realistic chance of rapidly dropping living standards in these countries.

In the end, I believe the only solution is to completely wipe out the debts and start from scratch. I don't really see an easy way out and there's an increasing risk of Europe breaking into war (I'm NOT saying Europe will go to war, I'm just saying that the risk exists and the risk is getting larger and will continue to do so if this can-kicking continues). Unfortunately, there aren't any easy solutions or quick fixes for these countries.

Tuesday, August 12, 2014

Guidelines for Building a Better Financial System

There's been much talk about how deregulation was the cause of the financial crisis and we need better regulation to prevent a financial crisis. This is a bunch of nonsense. The problem in the way our financial system operates is actually a very old one: it's the agency problem. The people who make the decisions for all of these firms are heads of the large financial companies who understand the most about the risks they take. Not only do these people understand the risks the best, but they also have a very skewed incentive structure. The heads of these companies get bonuses from making the firms money, but when the firms go bust, the people that've made those decisions still end up with lots of wealth.

So now the problem becomes a little bit clearer. The people who make decisions about finance are the same ones who have no incentive from actually making good decisions. The tradeoff these people face is that they make a lot of money if the firm does poorly or okay while they make even more money if the firm does well. Now, the problem becomes even more clear: the people who make the most important decisions in our financial system not only have the most understanding about the risks involved, but they also have absolutely no skin in the game.

The solution that's currently taken place is that we've got a set of politicians whose largest donors are the country's largest financial institutions write "regulations" whereby the people who wrote the "regulations" do not suffer from the negative consequences if the "regulations" are bad. On top of this, the same people who wrote the regulations are being paid by the guys who the "regulations" are supposed to be written for. It doesn't take a rocket scientist to figure out something isn't right here.

In addition to having inverse skin in the game, the financial regulatory agencies (ex. SEC, FTC, etc.) are run by people who were formerly employed by the financial industry and people who will probably be employed by the financial industry if they were to leave to work for the private sector. In other words, we've got another inverse skin in the game problem coming from a revolving door. Yet we also expect these people to the "right thing" even when the "right thing" involves going against their own interests. Obviously, this doesn't make any sense and has zero chance of working.

It's clearly obvious that the problem here isn't a lack of "regulation" and that we don't need "more regulation". What we need are people making decisions who actually suffer the negative consequences if they make mistakes, especially considering that the people making decisions are also those who understand the most about the consequences of their actions. In other words, what most of these bureaucrats do is effectively useless. These "regulatory agencies" are effectively parasites.

What we don't need are more complicated rules and regulations, but simple and clear rules. We don't need more agencies; we need better compensation systems. So what're the solutions?

So now the problem becomes a little bit clearer. The people who make decisions about finance are the same ones who have no incentive from actually making good decisions. The tradeoff these people face is that they make a lot of money if the firm does poorly or okay while they make even more money if the firm does well. Now, the problem becomes even more clear: the people who make the most important decisions in our financial system not only have the most understanding about the risks involved, but they also have absolutely no skin in the game.

The solution that's currently taken place is that we've got a set of politicians whose largest donors are the country's largest financial institutions write "regulations" whereby the people who wrote the "regulations" do not suffer from the negative consequences if the "regulations" are bad. On top of this, the same people who wrote the regulations are being paid by the guys who the "regulations" are supposed to be written for. It doesn't take a rocket scientist to figure out something isn't right here.

In addition to having inverse skin in the game, the financial regulatory agencies (ex. SEC, FTC, etc.) are run by people who were formerly employed by the financial industry and people who will probably be employed by the financial industry if they were to leave to work for the private sector. In other words, we've got another inverse skin in the game problem coming from a revolving door. Yet we also expect these people to the "right thing" even when the "right thing" involves going against their own interests. Obviously, this doesn't make any sense and has zero chance of working.

It's clearly obvious that the problem here isn't a lack of "regulation" and that we don't need "more regulation". What we need are people making decisions who actually suffer the negative consequences if they make mistakes, especially considering that the people making decisions are also those who understand the most about the consequences of their actions. In other words, what most of these bureaucrats do is effectively useless. These "regulatory agencies" are effectively parasites.

What we don't need are more complicated rules and regulations, but simple and clear rules. We don't need more agencies; we need better compensation systems. So what're the solutions?

- Eliminate almost all regulatory agencies. These agencies, not ironically, have an obvious agency problem that needs to be eliminated.

- Change the incentives of corporate executives so that if the financial firm goes bust, every single person who was in the board of directors and all of the top corporate executives over the past 15 years will have all of their assets liquidated and be personally liable for the losses of the firm.

- We also need transparency. This means that every single financial firm must publicly post all of its assets and liabilities on its website with absolutely no exceptions. If there is any sort of lying about the assets or liabilities of any financial firm, every single person in the board of directors and all of the top corporate executives should be tried for fraud with a minimum sentence of 7 years in prison.

Some might say that my rules are too harsh on the people who run these firms. If anything, my rules are not harsh enough. All I want is for those who make the most important decisions to be on the hook for the losses. The current problem with financial firms is that those who make the decisions do not suffer from the negative consequences of the decisions. Note that I do not care how much these people get paid. Choosing how much each person deserves to get paid or saying that one person "makes too much money" is stupid because there's no objective way to decide how much each person should be paid. If my rules lead to corporate executives being paid more money, I don't care because they will suffer the consequences of their actions.

Some might argue that these rules would cause many to not become corporate executives. To this I respond: if you can't handle the heat, then get the hell out of the kitchen. Right now, the guys who run these firms have no skin in the game. We need to have every single one of the corporate executives to make sure that they've got their necks on the line.

Note: These regulations would only apply to publicly traded financial firms, not firms like limited partnerships.

Note #2: There's a very good argument to say that these rules should be applied to the corporate executives for all of the publicly traded companies that currently exist. Personally, I think these rules should be applied to all publicly traded companies, but that's a different argument for a different day.

Monday, August 11, 2014

Travel Bans and Ebola

So far, there has been an Ebola outbreak in Nigeria, Liberia, Sierra-Leone, and Guinea. Travel in and out of these countries should be completely banned. These countries should be placed under strict quarantine until this outbreak is done with. Almost everyone would probably respond with the idea that my prescription is too harsh. If anything, it's not harsh enough.

First, I'll start by listing the facts. Ebola is a disease and this outbreak of Ebola has had a mortality rate of >50%. In other words, this version of Ebola is absolutely lethal. It's one of the most lethal viruses out there and there's no proven way of stopping it. Also note that there's a lot about Ebola that we do not fully understand. We do know that it's a virus, but some of its transmission mechanisms are not fully known. In other words, we're not fully sure of what exactly we're even fighting against.

Another important point of note is that the Ebola outbreak thus far has been contained in a few regions of Liberia, Nigeria, Sierra-Leone, and Guinea, but that doesn't mean very much. All of those countries are extremely poor areas without proper sanitation and public health. We must also recognize that Ebola has very similar symptoms to diseases that're very common in that area of the world like malaria, yellow fever, and many others--so the cases (and deaths) from Ebola are certainly underreported.

This disease cannot be allowed to spread to any other part of the world. If the mortality rate holds, we could be seriously talking about around 50% of the world's population dead. That scenario cannot be allowed to happen at any cost, regardless of the probability. If that means we have to take precautions that may seem to be extreme, so be it.

It makes absolutely no sense to trust the governments of countries that're not only poor, but incompetent and have been in political and social turmoil for, in some cases, centuries. A policy that's reliant on trusting these governments isn't just a bad idea--it's fucking stupid.

What we need to do is to immobilize travel in and out of these countries. If that means placing troops on the borders of these countries or putting up massive obstacles to get in and out, then that's what we have to do. If there are citizens of other countries who have contracted Ebola inside Guinea, Nigeria, Sierra-Leone, or Guinea, they can be transported to their home countries via quarantined wards on specific helicopters or planes. With those particular exceptions, there should be absolutely no travel between these countries. There's simply too much risk. It's morally wrong to risk death of half of the world's population. I'm NOT saying that half the world's population will die if we don't take up this methodology. However, I am saying that if there's even a .01% chance of death in half the world's population from this outbreak, then the risk of such an event cannot be allowed regardless of the consequences to the countries at hand.

First, I'll start by listing the facts. Ebola is a disease and this outbreak of Ebola has had a mortality rate of >50%. In other words, this version of Ebola is absolutely lethal. It's one of the most lethal viruses out there and there's no proven way of stopping it. Also note that there's a lot about Ebola that we do not fully understand. We do know that it's a virus, but some of its transmission mechanisms are not fully known. In other words, we're not fully sure of what exactly we're even fighting against.

Another important point of note is that the Ebola outbreak thus far has been contained in a few regions of Liberia, Nigeria, Sierra-Leone, and Guinea, but that doesn't mean very much. All of those countries are extremely poor areas without proper sanitation and public health. We must also recognize that Ebola has very similar symptoms to diseases that're very common in that area of the world like malaria, yellow fever, and many others--so the cases (and deaths) from Ebola are certainly underreported.

This disease cannot be allowed to spread to any other part of the world. If the mortality rate holds, we could be seriously talking about around 50% of the world's population dead. That scenario cannot be allowed to happen at any cost, regardless of the probability. If that means we have to take precautions that may seem to be extreme, so be it.

It makes absolutely no sense to trust the governments of countries that're not only poor, but incompetent and have been in political and social turmoil for, in some cases, centuries. A policy that's reliant on trusting these governments isn't just a bad idea--it's fucking stupid.

What we need to do is to immobilize travel in and out of these countries. If that means placing troops on the borders of these countries or putting up massive obstacles to get in and out, then that's what we have to do. If there are citizens of other countries who have contracted Ebola inside Guinea, Nigeria, Sierra-Leone, or Guinea, they can be transported to their home countries via quarantined wards on specific helicopters or planes. With those particular exceptions, there should be absolutely no travel between these countries. There's simply too much risk. It's morally wrong to risk death of half of the world's population. I'm NOT saying that half the world's population will die if we don't take up this methodology. However, I am saying that if there's even a .01% chance of death in half the world's population from this outbreak, then the risk of such an event cannot be allowed regardless of the consequences to the countries at hand.

Wednesday, August 6, 2014

Why IS/LM Sucks

So far, I've been doing a series on money and banking, monetary policy/quantitative easing (QE), and the impacts of QE. I'm kind of continuing the series (if you think this post is about continuing the series). In modern macroeconomics, students are taught IS/LM.

Before I touch on the basics of IS/LM and go into why it's not a very good macro model, I'll go through the history. Contrary to popular opinion, IS/LM was not a model developed by Keynes. IS/LM was developed by John Hicks in a paper titled Mr. Keynes and the Classics. IS/LM was a model developed by Hicks as it was Hicks' interpretation of Keynes' General Theory of Employment, Interest, and Money. However, Keynes explicitly rejects IS/LM in his paper, Alternative Theories of the Rate of Interest. Ironically, IS/LM is still taught by professors in economics and is portrayed as "Keynesian" when Keynes didn't have a very high opinion on the model. Here's a quote from Keynes talking about the "alternative theory" Keynes refers to in the quote below is the IS/LM model laid out by Hicks, Ohlin, and other economists.

Before I touch on the basics of IS/LM and go into why it's not a very good macro model, I'll go through the history. Contrary to popular opinion, IS/LM was not a model developed by Keynes. IS/LM was developed by John Hicks in a paper titled Mr. Keynes and the Classics. IS/LM was a model developed by Hicks as it was Hicks' interpretation of Keynes' General Theory of Employment, Interest, and Money. However, Keynes explicitly rejects IS/LM in his paper, Alternative Theories of the Rate of Interest. Ironically, IS/LM is still taught by professors in economics and is portrayed as "Keynesian" when Keynes didn't have a very high opinion on the model. Here's a quote from Keynes talking about the "alternative theory" Keynes refers to in the quote below is the IS/LM model laid out by Hicks, Ohlin, and other economists.

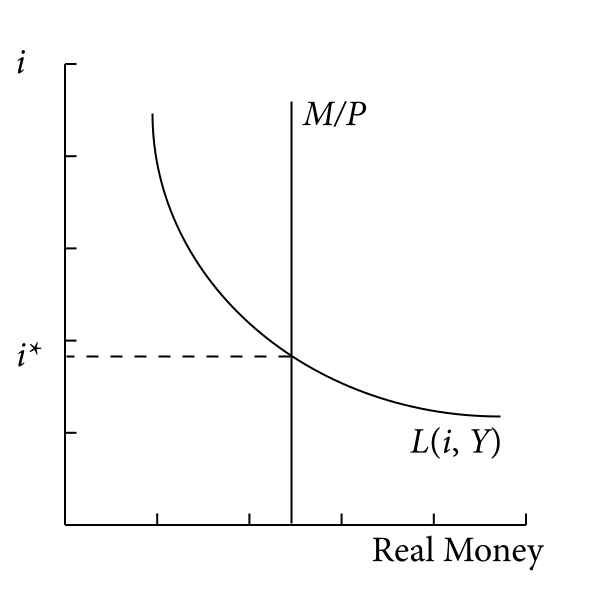

The alternative theory … makes it to depend … on the demand and supply of credit or, alternatively (meaning the same thing), of loans, at different rates of interest. Some of the writers … believe that my theory is, on the whole, the same as theirs and mainly amounts to expressing it in a somewhat different way. Nevertheless the theories are, I believe, radically opposed to one another.

IS/LM is a common method designed to teach economics students about the impact that shifting interest rates has on macroeconomies. IS/LM is initially derived by (correctly) assuming that the central banks shift the rate of interest by altering the supply of base money (or reserves). IS/LM also assumes that there's a magical stock of savings that get lent out by banks and get magically turned into loans. There are two curves that are drawn: the investment savings (IS) curve and the liquidity preference-money supply (LM) curve. The IS curve comes from the identity that investment and savings are equal. The IS curve is assumed to be downward sloping where an increase in the rate of interest leads to a drop in output and vice versa. The LM curve is derived from a (correct) graph (see the left chart below) that shows the relationship between the short term money market rate of interest as being set by the supply of base money and a downward sloping curve that represents the demand for base money. Then, the relationship between the rate of interest and the nominal income can be derived--which ends up being an upward sloping curve. The intersections between the two curves then determines both the rate of interest and the output level (see the chart on the right).

One of the primary problems with IS/LM is that it starts with the assumption that savings get lent out. In fact, savings do not get lent out. Loans always have, and always will, create deposits. There is an accounting identity that tells us S=I for a closed economy (and for the world economy--because the world is closed). However, S=I is an accounting identity derived from the fact that Y=C+I+NX=C+S which implies S=I+NX. In a closed economy, there are no net exports which tells us that S=I. It is a mistake to say that S=I because savings get lent out. If we use the framework of loans creating deposits, we end up realizing that the creation of debt creates money and investment is driven, not by an existing stock of savings that banks keep around, but by newly created money. This investment has to go to someone and ends up as someone else's income. We must remember that savings is, by definition, income not consumed. So investment actually creates savings. IS/LM makes the mistake of assuming savings creates investment.

Another mistake of IS/LM is that there's absolutely no theory of the yield curve. IS/LM gives students the impression that when the central bank lowers short term interest rates, output goes up because people start hold less securities and more money gets lent out. It can give the impression to students that lower interest rates mean higher inflation. In IS/LM, there is absolutely no theory about the yield curve or the rate of exchange. A better approach would be to talk about the present value effect and the impact of short term yields on asset prices. When central banks lower short term interest rates, they do so by expanding their balance sheets. They can buy a Treasury bill by issuing new dollars that either serve as bank reserves or show up as deposits on a dealer balance sheet. This means that not only do short term interest rates fall, but you've also shifted the asset portfolio of the private sector. The private sector will rebalance their portfolios, usually by buying assets of some kind with the extra cash they hold. In other words, central banks changing short term interest rates works by changing the liquidity structure of the private sector which forces the private sector to rebalance their portfolios. Another effect, as stated earlier, by having central banks set the short term rate of interest is the present value effect. The real value of an asset is the NPV of all the future expected cash flows and the real value or productivity of an asset like a factory will not change. However, changing the short term interest rate changes the future "safe" cash flow possible. Asset markets will naturally adjust such that lower short term interest rates usually mean higher asset prices and vice-versa. The reason lower short term interest rates are usually stimulative is because of the impact of the portfolio rebalancing effect and the present value effect--both of which put upward pressure on asset prices. The upward pressure on asset prices causes people to feel richer and consume more of their income (or take out more loans) today.

A third mistake of IS/LM is to completely ignore the differences between short term and long term rates. IS/LM provides no theory for the shape of the yield curve, but the shape of the yield curve is extremely important in determining what happens. There's a common mistake that's been made by several economists (including many heterodox economists) which is that a central bank that comes in to buy long term bonds reduces long term interest rates. The main point here is that having a central bank buy more securities and expand the base money supply doesn't mean that long term rates will move the same way as short term rates--particularly at the zero lower bound.

IS/LM also makes another critical error on the interest rate. The short term money market rate of interest is not the equilibrium rate where the supply of loanable funds meets the demand for loans. Instead, the short term money market rate of interest is simply the price of liquidity. Every single business MUST meet its cash commitments or otherwise it goes bust (liquidity constraint). The short term interest rate is the price at which any firm can obtain liquidity in order to make its payments and prevent itself from going bust. The bank doesn't really have a choice to acquire liquidity if the bank doesn't already have the liquidity on hand. The bank MUST acquire the liquidity and make its payments, regardless of the price. In other words, the short term interest rate isn't the equilibrium rate in the loanable funds marketplace. The short term market rate of interest is the price at which firms must obtain liquidity.

IS/LM also makes another critical error on the interest rate. The short term money market rate of interest is not the equilibrium rate where the supply of loanable funds meets the demand for loans. Instead, the short term money market rate of interest is simply the price of liquidity. Every single business MUST meet its cash commitments or otherwise it goes bust (liquidity constraint). The short term interest rate is the price at which any firm can obtain liquidity in order to make its payments and prevent itself from going bust. The bank doesn't really have a choice to acquire liquidity if the bank doesn't already have the liquidity on hand. The bank MUST acquire the liquidity and make its payments, regardless of the price. In other words, the short term interest rate isn't the equilibrium rate in the loanable funds marketplace. The short term market rate of interest is the price at which firms must obtain liquidity.

So far, I've assumed that the economy in question is closed and FX impacts are non-existent. Another problem with IS/LM is that IS/LM completely ignores FX effects and doesn't take into account the supply side structure of an economy. For example, a country that imports lots of food and energy will respond completely differently to reduction in the short term money market rate of interest (or an increase in the monetary base) than a country that's a heavy exporter of raw materials and energy. IS/LM effectively overlooks all of those factors.

Basically, IS/LM is a poor model. Although it gets some of the impacts correct (like not calling hyperinflation when the Fed buys massive amounts of assets at the zero lower bound), the thinking and the flaws in the model begin with its very assumptions. IS/LM is a bad way of getting students to think about economic factors and holds little use, even as a classroom gadget.

Note: I've only discussed what I find to be the most obvious flaws of IS/LM. Many more flaws exist with the model that I haven't covered in this post. How can any model talk about the impact of monetary policy without talking about the movement of asset prices? The reality is that such a model cannot accurately describe how the world works or even come close to doing so.

Basically, IS/LM is a poor model. Although it gets some of the impacts correct (like not calling hyperinflation when the Fed buys massive amounts of assets at the zero lower bound), the thinking and the flaws in the model begin with its very assumptions. IS/LM is a bad way of getting students to think about economic factors and holds little use, even as a classroom gadget.

Note: I've only discussed what I find to be the most obvious flaws of IS/LM. Many more flaws exist with the model that I haven't covered in this post. How can any model talk about the impact of monetary policy without talking about the movement of asset prices? The reality is that such a model cannot accurately describe how the world works or even come close to doing so.

Monday, August 4, 2014

Impact of QE

This is my third part in my series on money and banking. In my first post on money and banking, I talk about the very basics of money and banking (mainly about loans creating deposits and the implications of loans creating deposits). In my second post of the series, I spoke about the basics of monetary policy and what quantitative easing (QE) is. In this installment of the series, I'll talk about the impacts of the Fed's QE policy. Before I start talking about the impacts of QE, I'll talk about the misconceptions of QE.

There's a common misconception that QE is decreasing the yields on bonds (or equivalently, raising the price). The idea continues that QE stimulates the economy by reducing long term rates to induce borrowing in a very IS/LM-like manner. However, this proposition does not seem to hold empirically. Every single time the Federal Reserve has taken up a QE program, yields on long term bonds have gone up, not down. On top of this, long term rates have continued to stay elevated until after the programs were discontinued. In the case of the QE 3 program, long term rates have consistently gone down as the Fed has tapered its bond purchases. I've showed the chart below which shows how long term interest rates and you'll see that rates have indeed gone up when the QE programs were announced AND stayed elevated until the programs were discontinued. We can clearly falsify the idea that QE reduces long term rates and stimulates the economy by inducing borrowing.

Note: The guys running the Fed think that QE reduces long term rates even though the narrative is obviously false (this is a major problem as they clearly do not understand the impacts and mechanisms of QE).

Note: Long term rates have dropped significantly since the Fed has started tapering and the 10 year is now <2.5%.

QE certainly does impact the economy, but it doesn't do so by reducing long term rates to stimulate borrowing. Recall that QE is simply an asset swap whereby the private sector sees a reduction in its bond holdings and receives cash instead. QE was done after the country hit the zero lower bound when increasing the monetary base has little effect on the short term money market rate of interest, which was already taken down to zero. In other words, QE effectively creates a gigantic pile of cash looking to go somewhere while limiting the amount of bonds that can be held by the private sector.

By reducing the amount of bonds that can be held by the private sector while increasing the amount of cash held by the private sector, investors/traders will naturally shift their behavior by shifting the amount of assets they hold. Basically, QE works by the private sector rebalancing their portfolios. Market participants, all of a sudden, find themselves holding more cash and less bonds. This means they'll naturally want to rotate out of cash and into other assets. QE works by creating a gigantic pile of cash looking to go somewhere while the private sector will be holding less bonds. So QE causes rotation of capital out of certain asset classes into others. Where does this gigantic pile of cash and liquid assets go? It usually flows into assets like equities and foreign assets. Note that if there's a flow of capital into foreign assets, other countries will be receiving capital inflows. So the primary effect of QE is international. The capital flows don't just show up in foreign assets, but investors also rotate into other assets such as equities and high yield debt.

The primary (and most obvious) effect of QE is that it creates capital outflows from the US into emerging markets. It is my belief that much of the boom in asset prices we've seen in emerging markets since 2008-09 has been due to capital inflows from the US supporting their currencies and asset prices. In many of these countries, we've been starting to see asset bubbles and many of these asset bubbles are being driven by the Federal Reserve's QE. In a sense, QE can be considered a form of a currency war.

The second effect of QE is that it has created negative real lending rates (interest rates minus NGDP growth rates), which subsidizes producers at the expense of consumers. In other words, QE actually subsidizes and places upward pressure on US production. Negative real lending rates allow producers (particularly large manufacturers) to have access to very cheap capital which can be used for production. Negative real lending rates, in general, hurt net savers. If we split the economy into three separate sectors (households, businesses, and governments), we see that households are net savers while businesses and governments are net borrowers. Since QE (and negative real lending rates) help borrowers at the expense of savers, QE tend to benefit businesses and governments at the expense of households.

The third effect of QE on the real economy is that QE actually drives up the savings rate. It may seem strange to think that QE hurts net savers while driving up the savings rate, but it's not strange at all. The confusion comes because of the difference between the total savings rate of an economy and household savings--those two are not the same! We must first remember that savings is defined as income not consumed. It's also obvious that businesses and governments consume much less resources than households (S=Y-C). So if we transfer resources from net savers (households) to net borrowers (firms and governments), we will see an increase in the savings rate. Note that this may or may not increase the real debt burden (measuring debt in nominal terms is useless, debt/debt servicing capacity ratios provide much more information)--it depends on the resulting shifts in productivity relative to the debt servicing cost.

Another effect of QE is that it allows the federal government the ability to collect on seigniorage (the real profit from the issuance of currency). As I discussed in my previous post, QE means that the central bank buys Treasury bonds and mortgage-backed securities (MBSs) by creating new currency in the system. The currency in the system shows up as bank deposits or as bank reserves. Note that the Fed gets a return from holding those Treasuries and MBSs while the Fed pays out a certain interest rate on bank reserves (but not on the rest of the currency in the system). Also note that all of the profits/losses of the Federal Reserve show up on the Treasury's cash flow. Currently, the Fed pays out .5% annually on the bank reserves while it gains (much) higher interest rate on the Treasuries and MBSs that it holds. The resulting interest rate spread is revenue that's being collected as seigniorage by the Treasury.

Note: QE has created a serious risk of asset market destabilization. As I previously stated, the point of QE is to gigantic pile of cash that's looking to go somewhere while limiting the amount of bonds available to the private sector. This means there's more cash available and less of that cash is going into bonds (particularly since bond prices are falling during QE). Obviously, there's a real risk of asset market destabilization, which we're currently seeing.

Subscribe to:

Comments (Atom)